ri tax rate on gambling winnings

Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. Ri Tax Rate On Gambling Winnings - Find honest info on the most trusted safe sites to play online casino games and gamble for real money.

Rhode Island Slot Machine Casino Gambling Professor Slots

It is often misreported that you dont owe taxes on winnings less than 600.

. Gambling Income Tax Requirements for Nonresidents. Thus an amateur gambler with 50000. This is part of a revenue sharing model Rhode Island have with Delaware.

24 of winnings over a certain amount are kept by the IRS. Effective on and after July 1 1989 amounts received from or paid on behalf of the Rhode Island Lottery as winnings and prizes are taxable under the provisions of the Rhode Island personal. You must report all gambling winnings to the IRS regardless of amount.

While regulating casino gambling the RI authorities. Ri Tax Rate On Gambling Winnings - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. Rhode Island eliminated itemized deductions but did increase the standard deduction.

Winnings are taxed the same as wages or salaries are and the total amount the winner. Discover the best slot machine games types jackpots FREE games. Little Rhody Rhode Island changed its tax structure for 2012.

To report gambling winnings on Form 1040NR. Ri Tax Rate On Gambling Winnings - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. The Rhode Island state tax on gambling winnings varies depending on your overall annual income with the lowest being set at.

It is your responsibility to correctly declare any winnings on your end-of-year tax return. The IRS requires nonresidents of the US. Different types of gambling.

Depending on the amount of his winnings Rhode Island withholding may. Ri Tax Rate On Gambling Winnings - Find honest info on the most trusted safe sites to play online casino games and gamble for real money. For Georges Rhode Island income tax purposes his winnings are taxable as part of his 1989 Rhode Island income.

Discover the best slot machine games types jackpots FREE games. Poker texas holdem valores red. How much is a room at soaring.

Rhode Island has an oddly high gambling winnings state tax of 51 on all gambling winnings revenue.

Free Gambling Winnings Tax Calculator All 50 Us States

How To Declare Gambling Income In The Us Sportingpedia Latest Sports News From All Over The World

News Insights Clarksilva Warwick Ri Certified Public Accountants

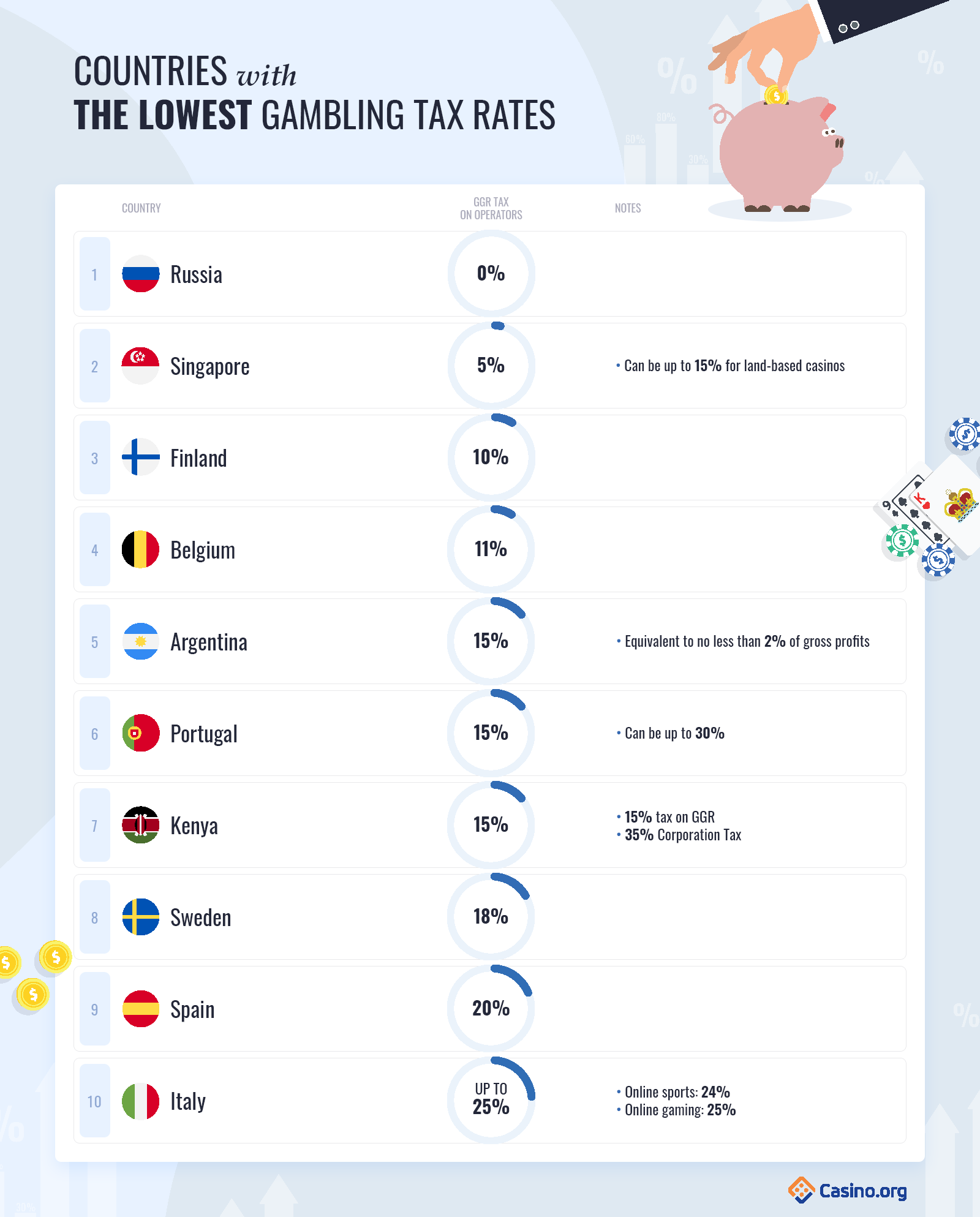

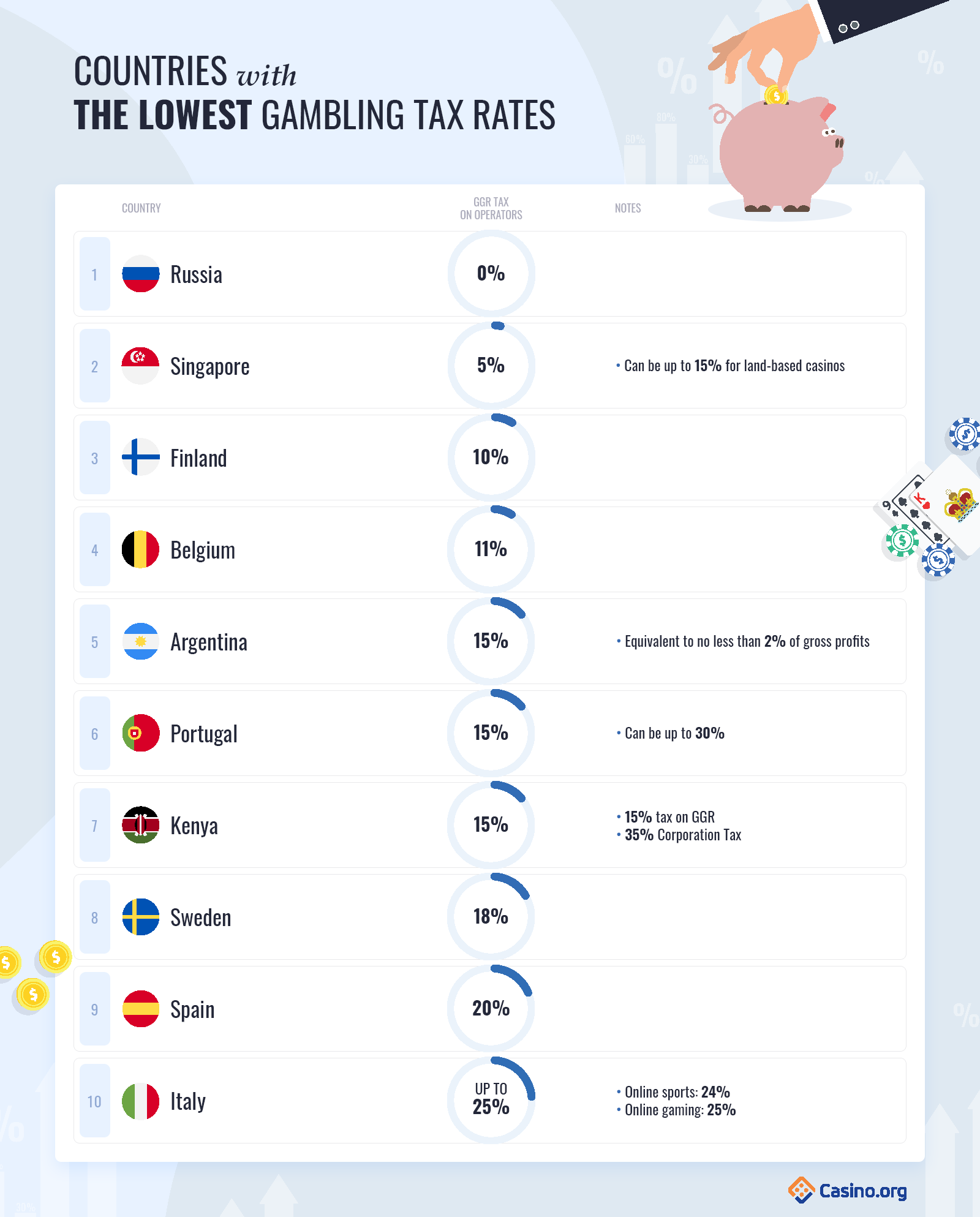

How Much Tax Casinos Pay Top 10 Highest Lowest Countries

How To Use The W 2g Tax Form To Report Gambling Income Turbotax Tax Tips Videos

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Online Gambling Taxes Do I Have To Pay Tax On Winnings 2022

Gambling Winnings Tax H R Block

Golocalprov Welcome To Ri S Next Wild Wild West Sports Betting

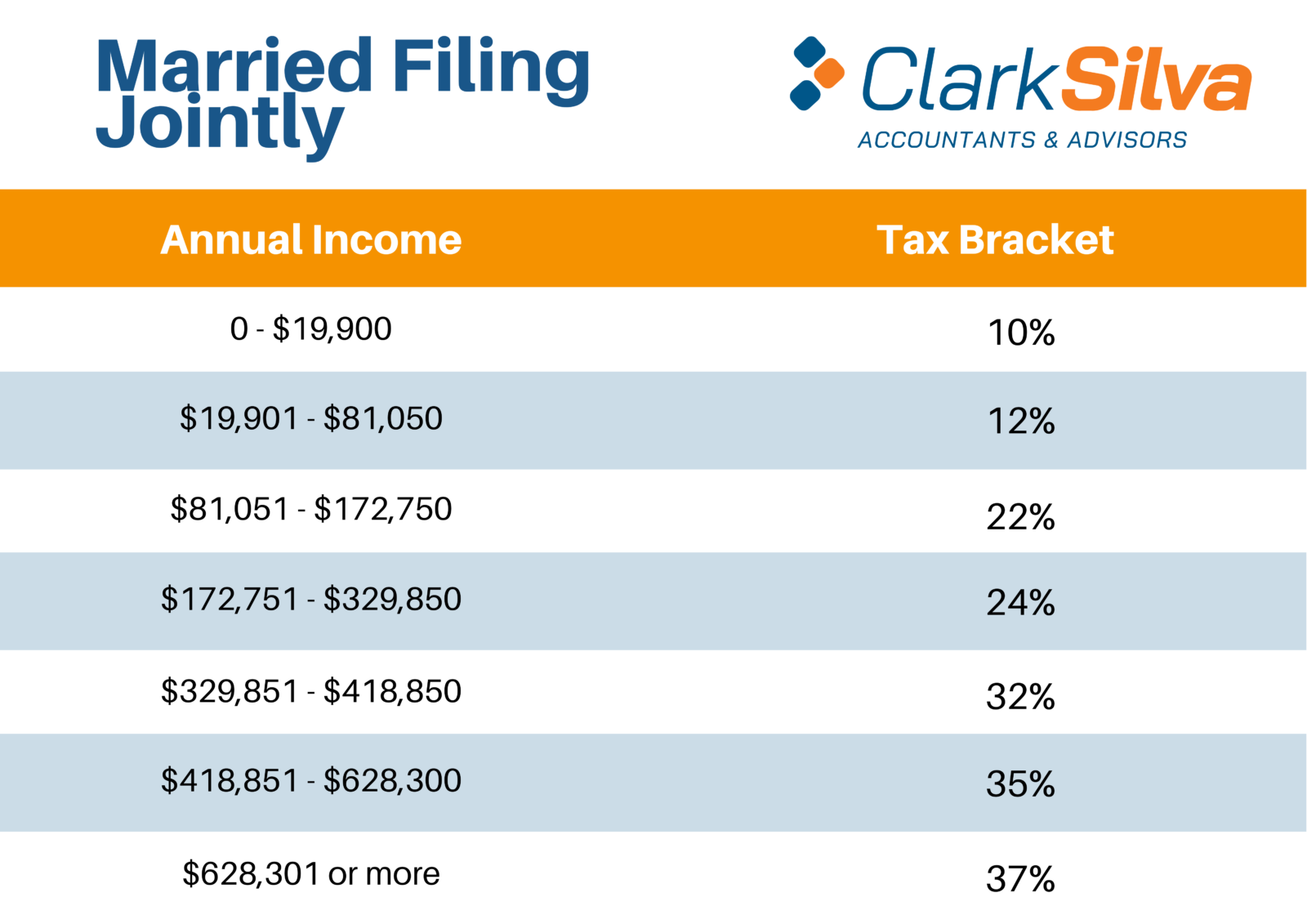

Federal Income Tax Brackets Released For 2021 Has Yours Changed Clarksilva Certified Public Accountants Advisors

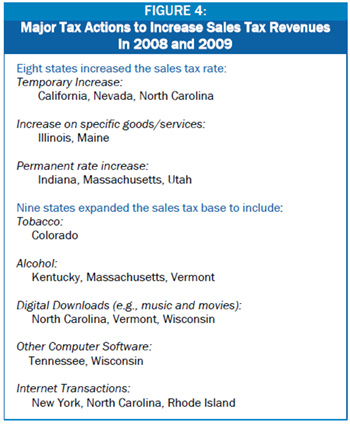

State Tax Changes In Response To The Recession Center On Budget And Policy Priorities

Rhode Island Sports Betting 2022 Legal Ri Sports Betting

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Everything You Need To Know About Massachusetts New Sports Betting Law Wbur News

Rhode Island Sports Betting 2022 Legal Ri Sports Betting

Fact Sheet Sports Betting Georgia Budget And Policy Institute